Why You Need Employees vs. Contractors in Your Wedding Business: Avoid Costly Misclassification Fines

Hey There, CEO!

What I’m about to share could make or break your wedding business. I’m not one to sugarcoat things, so here it is: if you’re still paying your team as contractors, you’re playing with fire. I know it might seem like an easy, cost-effective solution, but trust me, it could be the most expensive mistake you ever make.

In this episode of the Wedding Pro CEO Podcast, I sat down with Kira La Forgia, the brilliant mind behind Paradigm Group, to talk about why properly classifying your team as employees versus contractors is not just a legal obligation—it’s a strategic move that will protect your business from crushing fines and set you up for long-term success.

The High Stakes of Misclassification

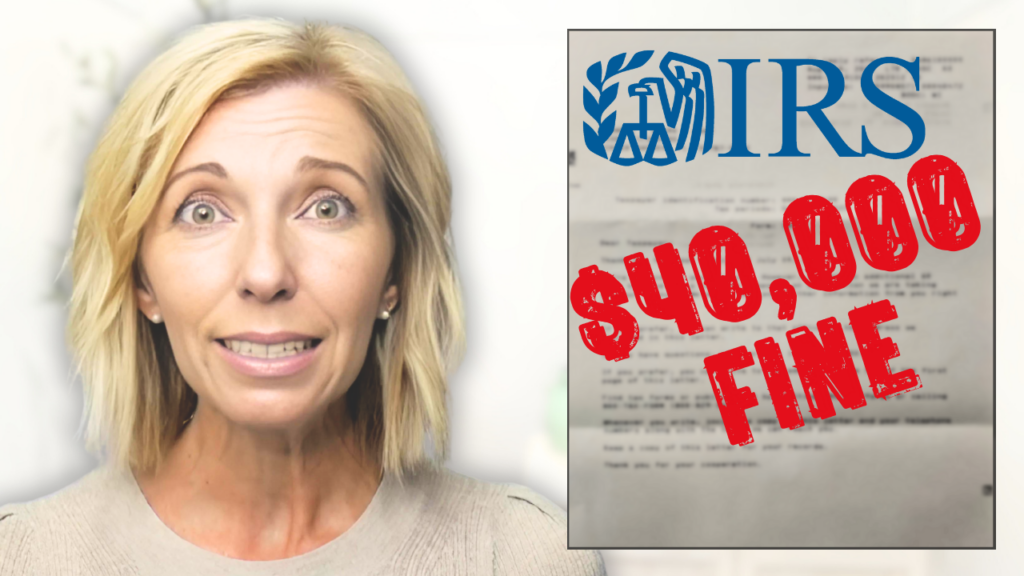

Let’s get one thing straight: misclassifying your employees as contractors isn’t just a minor slip-up; it’s a ticking time bomb. Kira didn’t hold back when she shared that fines for misclassification can range anywhere from $5,000 to $40,000 even up to $180,000. That’s not chump change, CEO—that’s the kind of penalty that can wipe out a small business.

“Building a team isn’t just about compliance; it’s about creating a thriving culture where your people feel valued and excited to grow with you. Your business is only as strong as the team behind it.” — Kira La Forgia

Imagine getting slapped with a $45,000 fine. For most wedding pros, that’s game over. You’re not just risking a little; you’re risking everything you’ve built. So, if you’ve been on the fence about making the switch, consider this your wake-up call.

Why the Law Does Not Play Around

I get it. You might be thinking, “But my contractors are happy! They like the flexibility.” Well, that’s great, but guess what? The law doesn’t care about your contractors’ preferences. The Department of Labor cares about whether or not you’re following the rules, and those rules got a serious update in March 2023.

The latest ruling lays out six key factors that determine whether someone should be classified as an employee or a contractor, and one of the biggest factors is control. If you’re telling someone when, where, and how to work, they’re likely an employee. Period.

The wedding industry is especially tricky here—think about your coordinators, second shooters, and assistants. If they’re following your guidelines and schedule, you’re in employee territory, and ignoring that fact could cost you big time.

The Ethical Bottom Line

But let’s step back for a second because this isn’t just about staying out of trouble—this is about doing the right thing. When you misclassify someone as a contractor, you’re stripping them of crucial benefits like unemployment, workers’ compensation, and other protections that employees are entitled to. During the pandemic, we saw how critical these benefits are, and it was a harsh reality check for many business owners.

As CEOs, we have a responsibility not just to our clients, but to our team. If you’re using contractors to save a few bucks, you’re essentially telling them that their financial security isn’t your concern. And that, my friends, is exploitation. We’re better than that.

“Misclassifying your team as contractors instead of employees isn’t just risky—it’s illegal. Understanding the difference is crucial to avoiding devastating fines and building a sustainable business.” — Kira La Forgia

The Myth of the “Cheaper Contractor”

Let’s talk about the money side of things because I know some of you are still thinking that contractors are the cheaper option.

Here’s the truth: while contractors might seem like a bargain at first, the hidden costs can outweigh any initial savings.

You lose control over how they work, when they work, and the quality of what they deliver. Plus, they’re likely juggling other clients, which means your business isn’t always their top priority. In the high-stakes world of weddings, that’s a risk you just can’t afford.

Employees, on the other hand, bring consistency and reliability to the table. They’re invested in your business’s success because it directly impacts their livelihood. When you invest in employees, you’re building a team that’s as committed to your vision as you are. And that’s priceless.

“If you want commitment from your team, you need to show commitment to them first. Hiring employees isn’t just about following the law—it’s about creating a team that’s invested in your vision.” — Brandee Gaar

Why Embracing Employees Will Propel Your Business Forward

Here’s where the magic happens: shifting from contractors to employees isn’t just about compliance—it’s about taking control of your business’s future.

- Control and Consistency: With employees, you set the rules. You dictate how things get done, ensuring that every aspect of your service meets your brand standards. This control is critical in delivering the exceptional experiences that keep clients coming back.

- Building a Powerhouse Culture: Employees aren’t just workers—they’re part of your brand’s DNA. They contribute to a strong, positive company culture that makes your business not just a job, but a place people want to be.

- Scalability and Growth: If you’re serious about scaling to seven figures, you need a team that’s all in. Contractors can help you get by, but employees help you grow. They’re your partners in building something bigger than yourself.

- Legal and Ethical Compliance: By getting your team classifications right, you’re not just dodging fines—you’re showing that you run your business with integrity. You’re playing by the rules, and in doing so, you’re setting an example for others in the industry.

“Getting your HR in line isn’t just about avoiding fines—it’s about setting the foundation for growth and ensuring your business can scale with confidence.” — Brandee Gaar

How to Make the Transition

Ready to take the leap? Good. Here’s how you do it:

- Evaluate Your Current Team: Take a hard look at who’s working for you and how they’re classified. If you’re controlling their work, they’re employees. It’s that simple.

- Get Expert Help: Don’t go it alone. Partner with an HR expert like Kira to make sure you’re doing it right. This isn’t the time to wing it.

- Communicate the Change: Be upfront with your team. Explain why you’re making this change and how it benefits them. Trust me, transparency goes a long way.

- Update Payroll and Contracts: Get your payroll systems in place to handle taxes and benefits for your new employees. Update any contracts to reflect their new status.

- Invest in Onboarding and Training: Employees are an investment. Make sure they’re set up for success with proper onboarding and ongoing training. This is how you build a team that’s in it for the long haul.

Before We Go

Look, if you’re here, it’s because you’re serious about growing your wedding business into something big. Something that lasts. You’re not interested in just scraping by—you’re aiming for seven figures and beyond. But you’re not going to get there by cutting corners with contractors. You need a strong, compliant team that’s ready to go the distance with you.

Don’t wait until you’re facing a $40,000 fine to make a change. Start now. Make the smart, strategic move to employees, and watch how it transforms your business. You’ve got the vision. Now, let’s build the team that’s going to make it a reality.

Check Out The Paradigm, a Service Centered HR Without The Corporate Feel:

https://www.the-paradigm.com

Follow Kira La Forgia on Instagram or Linked In:

https://www.instagram.com/theparadigmm/

https://www.linkedin.com/in/kiralaforgia/

FAQ

Q: What’s the biggest risk of misclassifying employees as contractors?

A: The biggest risk is the possibility of massive fines—Kira mentioned anywhere from $5,000 to $180,000. Misclassification can also trigger audits, back taxes, and legal headaches that could put you out of business.

Q: How do I know if someone should be classified as an employee?

A: If you’re controlling when, where, and how someone works, they’re likely an employee. The Department of Labor has six key factors that guide classification, with control being a major one.

Q: Are employees more expensive than contractors?

A: Not necessarily. While employees do come with taxes and benefits, they often deliver higher consistency and reliability, leading to a better return on investment and more sustainable business growth.

Q: How do businesses typically get caught for misclassification?

A: Audits can be triggered by things like contractors applying for unemployment benefits or repeated payments to the same individuals. The IRS has ways of flagging misclassification, and fines can be steep.

Q: Why should I invest in employees over contractors?

A: Employees offer more control, consistency, and a stronger company culture. They’re essential for scaling your business and ensuring legal and ethical compliance.

Check out the video version of the podcast below. 👇

Subscribe to support the channel.

Ready to Build Your Profitable Business?

Join the Wedding Pro CEO Accelerator: A 6-month program for established wedding pros who are ready to ditch the overwhelm, create consistent profit, build their dream team and confidently grow their revenue to $100k/year and beyond.

👩💻Download my free live training to learn how to double your wedding business revenue

💌For business inquiries: sayhello@brandeegaar.com

Hey there!

I'm Brandee!

I help creative business owners sustainably scale their business so they can create a thriving career and work-life balance.

entrepreneur

small biz coach

mom

wife

browse the ceo learning hub

work with me

September 3, 2024

Why Your Wedding Business Needs Employees Over Contractors. w/ Kira La Forgia

Psst. Are you looking for speakers for your next event?

I have experience speaking at both live and virtual events, educating creative and wedding entrepreneurs how to step into their role as CEO. If you're looking for speakers for your next conference, workshop, event, or the next guest for your podcast, I'd love to see how we can collaborate!

Hey there!

I'm

Brandee!

your business bestie + mentor + coach + cheerleader for wedding professionals and creative entrepreneurs

@brandeegaar

Want to learn how to Convert more leads into buying clients?

Get the emails!